| | • Advisory vote approving the compensation of our named executive officers | | 2. | The ratification• Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2019 |

For the Trustees: | 3. | An advisory vote approving the compensation of our named executive officers. |

| 4. | An advisory vote on the frequency of holding future votes on the compensation of our named executive officers. |

Dawn M. Becker Executive Vice President—General Counsel and Secretary March 22, 2019 HOW TO VOTE | 5. | The transaction of such other business as may properly come before the Annual Meeting or any adjournment. |

ShareholdersYour vote is important to us. You are eligible to vote and receive notice of the meeting if you were a registered owner of record of our common shares of beneficial interest (“Shares”) at the close of business on the March 14, 2017 are2019 record date. A majority of the Shares entitled to notice of and to vote at the Annual Meeting must be present in person or by proxy for us to proceed with the Annual Meeting.

ForIf you own your Shares directly with our transfer agent, American Stock Transfer and Trust, LLC, you are a registered shareholder and can vote either in person at the Trustees:Annual Meeting or by proxy without attending the Annual Meeting through one of the following methods:

| | | | |  | |  | |  | Visitwww.voteproxy.com. You will need the control number on your Notice of Internet Availability, proxy card or voting instruction form. Votes must be submitted by 11:59 pm EDT on April 30, 2019 to be counted for the meeting. | | Call1-800-Proxies(1-800-776-9437). You will need the control number on your Notice of Internet Availability, proxy card or voting instruction form. Votes must be submitted by 11:59 pm EDT on April 30, 2019 to be counted for the meeting. | | You can vote my marking, signing and dating your proxy card. |

Dawn M. Becker

Executive Vice President—General

Counsel and Secretary

Your vote is important. Even if you plan to attend the meeting, please vote via the Internet (www.voteproxy.com) or by telephone(1-800-PROXIES or1-800-776-9437) by following the instructions on the Notice of Internet Availability of Proxy Materials or as instructed in the accompanying proxy. If you received or requested a copy of the proxy card by mail or bye-mail, you may submit your vote by mail; however, we encourage you to vote via the Internet or by telephone. These methods are convenient and save us significant postage and processing charges. If you attend the meeting, youYou may revoke your proxy at any time before it is voted at the Annual Meeting by notifying the secretary in writing, submitting a proxy dated later than your original proxy, or attending the Annual Meeting and votevoting in person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 3, 2017 The 2017OUR ANNUAL MEETING.Our 2019 Proxy Statement and 20162018 Annual Report to Shareholders, which includes our Annual Report on Form10-K for the year ended December 31, 2016,2018, are available at www.federalrealty.com.www.federalrealty.com.

1626 East Jefferson Street, Rockville, Maryland 20852

PROXY STATEMENT SUMMARYABOUT FEDERAL REALTY

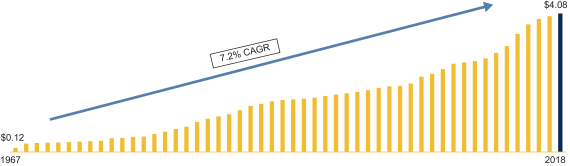

Federal Realty Investment Trust is a recognized leader in the ownership, operation and redevelopment of high-quality retail based real estate located primarily in major coastal markets from Washington, D.C. to Boston as well as San Francisco and Los Angeles. Founded in 1962, our mission is to deliver long term, sustainable growth through investing in densely populated, affluent communities where retail demand exceeds supply. Our expertise includes creating urban,mixed-use neighborhoods like Santana Row in San Jose, California, Pike & Rose in North Bethesda, Maryland and Assembly Row in Somerville, Massachusetts. These unique and vibrant environments that combine shopping, dining, living and working provide a destination experience valued by their respective communities. Federal Realty’s 105 properties include approximately 3,000 tenants, in approximately 24 million square feet, and over 2,600 residential units. Throughout this proxy statement, we use the terms “Federal Realty”, “Company”, “Trust”, “we”, “our” and “us” to refer to Federal Realty Investment Trust and the terms “Board” and “Trustees” used throughout this proxy statement refer to the Board of Trustees of Federal Realty Investment Trust. ANNUAL MEETING INFORMATION We are providing these proxy materials in connection with the 20172019 Annual Meeting of the Shareholders (“Annual Meeting”) of Federal Realty Investment Trust (the “Trust”).the Trust. These materials will assist you in voting your common shares of beneficial interest of the Trust (“Shares”)Shares by providing information on matters that will be presented at the Annual Meeting. 2017 ANNUAL MEETING OF SHAREHOLDERS

| | | | | Meeting Date: | | Wednesday, May 3, 20171, 2019 | | | Meeting Time: | | 10:00 a.m. local time | | | Meeting Location: | | AMP by Strathmore, 11810 Grand Park Avenue, North Bethesda, Maryland | | | Record Date: | | March 14, 2017 | | 2019 Proxies:

| | Dawn Becker and Dan Guglielmone | Inspector of Elections:

| | Dawn Becker or American Stock Transfer and Trust Company |

VOTING MATTERS AND VOTE RECOMMENDATIONSThe following matters are being presented for a vote at the 2019 Annual Meeting of Shareholders:

| | | | | Proposal | | Board

Recommendation | | Vote Required

For Approval | | | | The electionElection of seven8 Trustees to serve until our 2018 Annual Meeting of Shareholders2020 annual meeting

| | FOR all nomineeseach nominee | | Majority of votes cast | | | | The ratificationAdvisory vote on the compensation of our named executive officers

| | FOR | | Majority of votes cast | | | | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017auditors | | FOR | An advisory vote approving the compensation of our named executive officers

| | FOR | An advisory vote on the frequencyMajority of voting on the compensation of our named executive officersvotes cast

| | ANNUAL VOTE |

NOTICE OF ELECTRONIC AVAILABILITY OF PROXY MATERIALS We are furnishing proxy materials including this proxy statement and our 20162018 Annual Report to Shareholders, which includes our Annual Report on Form10-K for the year ended December 31, 20162018 (“Annual Report”), to each shareholder by providing access to such documents on the Internet instead of mailing printed copies unless you previously requested to receive these materials by mail ore-mail.Internet. On or about March 23, 2017,22, 2019, we mailed to our shareholders who have not previously requested to receive these materials by mail ore-mail a “Notice of Internet Availability of Proxy Materials” (“Notice”) containing instructions on how to access and review this proxy statement and our Annual Report and how to submit your vote on the Internet or by telephone. You cannot vote by marking the Notice and returning it. If you received the Notice, by mail, you will not automatically receive a printed copy of our proxy materials or Annual Report unless you follow the instructions for requesting these materials included in the Notice. ABOUT THE ANNUAL MEETING

You are receiving This section does not apply if you previously requested to receive these materials because you owned our Shares as of March 14, 2017, the record date established by ourmail.

| CORPORATE GOVERNANCE INFORMATION |

The Board of Trustees (“Board”)is responsible for our Annual Meeting of Shareholders (“Annual Meeting”). Everyone who owned our Shares as of that date, whether directly as a registered shareholder or indirectly through a broker or other nominee, is entitled to vote at the Annual Meeting. We had 72,172,665 Shares outstanding on March 14, 2017. A majorityproviding governance and oversight of the Shares entitled to vote at the Annual Meeting must be present in person or by proxy for us to proceed with the Annual Meeting.

As a shareholder, you are entitled to cast one vote per Share; however, as to the election of Trustees, you are entitled to cast one vote per Share for eachstrategy, operations and management of the seven open trustee positions. If you hold your Shares in different ways (i.e., joint tenancy, trusts, custodial accounts) or in multiple accounts, you will receive more than one Notice, proxy card, voting instruction form or email, or any combinationTrust on behalf of these. You should provide voting instructions for all Notices, proxy cards, voting instruction forms and email links you receive.

If you are a registered shareholder owning your Shares directly, you can vote either in person at the Annual Meeting or by proxy without attending the Annual Meeting through one ofour shareholders. Our Board has adopted the following methods:key documents, together with our Bylaws, that form the governance framework for the Trust. Each of these documents is periodically reviewed and updated to confirm they provide the appropriate governance framework for the Trust and to comply with current regulatory and governance requirements.

By telephone by dialing1-800-PROXIES(1-800-776-9437)Corporate Governance Guidelines

Code of Ethics for Senior Financial Officers | • | | Through the internet atwww.voteproxy.com

|

By completing and signingThese documents are available under the accompanying proxy card if you elect to receive shareholder materials by mail. When you return a proxy card that is properly signed and completed, the Shares represented by your proxy will be voted as you specify on the proxy card. If you sign and return your proxy card without indicating how you want your Shares to be voted, Dawn M. Becker and Daniel Guglielmone will vote your Shares in accordance with the recommendations of the Board.

Votes submitted by telephone or through the Internet must be received by 11:59 p.m., eastern daylight time, on May 2, 2017 in order to be counted for the Annual Meeting. Please see the Notice or proxy card for instructions on how to access the telephone and Internet voting systems. If you wish to change your vote, you may generally revoke your original vote by submitting a subsequent proxy.

Abstentions will only be counted as present for determining whether we can hold the Annual Meeting. If you do not vote your Shares, your Shares will not be counted and we may not be able to hold the Annual Meeting. We encourage you to vote by proxy using one of the methods described above even if you plan to attend the Annual Meeting in person so that we will know as soon as possible whether enough votes will be present.

For those of you holding your Shares indirectly through a broker or other nominee, you should receive all proxy materials from them and you must either direct them as to how to vote your Shares, or obtain from them a proxy to vote at the Annual Meeting. Please refer to the notice of internet availability of proxy materials or the voter instruction card used by your broker or other nominee for specific instructions on methods of voting. If you fail to give your broker or other nominee specific instructions on how to vote your Shares with respect to Proposals 1, 3 and 4, your vote will NOT be counted for those matters. It is important for every shareholder’s vote to be counted on these matters so we encourage you to provide your broker or other nominee with voting instructions. If you fail to give your broker or other nominee specific instructions on how to vote your Shares on Proposal 2, your broker or other nominee will generally be able to vote on Proposal 2 as he, she or it determines.

In the future, if you own your Shares directly and would like to receive proxy materials by email, you may register to do so atwww.astfinancial.com in which case you will receive an email containing links to our proxy materials. If you own Shares through a broker or other nominee and want to receive proxy materials via email, you must contact your broker or other nominee for instructions. Your election to receive your proxy materials by email delivery will remain in effect for all future annual meetings until you revoke it.

Shareholders can access this Proxy Statement, our Annual Report and our other filings with the Securities and Exchange Commission (“SEC”) on the Investors pageInvestors/Corporate Governance section of our website atwww.federalrealty.com. A copyPrinted copies of our Annual Report, including the financial statements and financial statement schedules (“Form10-K”) is being providedthese documents are also available free of charge upon written request to shareholders along with this Proxy Statement. The Form10-K includes certain exhibits, which we will provide to you only upon request addressed toour Investor Relations Department at 1626 East Jefferson Street, Rockville, Maryland 20852.

CORPORATE GOVERNANCE PRACTICES The request must be accompanied by paymentTrust has a history of a feestrong corporate governance and is committed to cover our reasonable expenses for copyingpractices and mailingpolicies that best serve the Form10-K. If you elected to receive our shareholder materials via the Internet or email, you may request paper copies, without charge, by written request addressed to the address set forth above. The SEC’s rules permit us to deliver a single Notice or single set of Annual Meeting materials to one address shared by two or moreinterests of our shareholders unless we have received contrary instructions from shareholders. This procedure, referred to as “householding”, reducesOur practices and policies include, among other things, the volume of duplicate information shareholders receive and can result in significant savings on mailing and printing costs. To take advantage of this opportunity, only one Notice, Proxy Statement and Annual Report is being delivered to multiple shareholders who share a single address, unless any shareholder residing at that address gave contrary instructions. If any shareholder sharing an address with another shareholder wants to receive a separate copy of this Proxy Statement and the Annual Report or wishes to receive a separate proxy statement and annual report in the future, or receives multiple copies of the proxy statement and Annual Report and wishes to receive a single copy, the shareholder should provide such instructions by calling our Investor Relations Department at(800) 937-5449, by writing to Investor Relations at 1626 East Jefferson Street, Rockville, Maryland 20852, or by sending ane-mail to Investor Relations atIR@federalrealty.com.following:

Questions regarding the Notice, voting or email delivery should be directed to our Investor Relations Department at (800)937-5449 or by email atIR@federalrealty.com.

OWNERSHIP INFORMATION

OWNERSHIP OF PRINCIPAL SHAREHOLDERS

Based upon our records and the information reported in filings with the SEC, the following were beneficial owners of more than 5% of our Shares as of March 14, 2017:

| | | | | | | | | Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | | Percentage of Our Outstanding Shares (1) | | The Vanguard Group, Inc.(2) 100 Vanguard Blvd. Malvern, PA 19355 | | | 12,222,133 | | | | 16.9 | % | | | | BlackRock, Inc.(3) 55 East 52nd Street New York, NY 10055 | | | 7,538,685 | | | | 10.4 | % | | | | State Street Corporation(4) State Street Financial Center, One Lincoln Street Boston, MA 02111 | | | 5,646,994 | | | | 7.8 | % | | | | Vanguard Specialized Funds—Vanguard REIT Index Fund(5) 100 Vanguard Blvd. Malvern, PA 19355 | | | 5,419,307 | | | | 7.5 | % | | | | Invesco Ltd.(6) 1555 Peachtree Street, NE, Suite 1800 Atlanta, GA 30309 | | | 3,705,292 | | | | 5.1 | % |

(1) | The percentage | | | | | | | Board Composition | | Shareholder Rights | | Key Policies | | | | ✓ 75% of outstanding SharesBoard is calculatedIndependent | | ✓ Shareholder Right to Call Special Meeting without Significant Restriction | | ✓ Pay for Performance Executive Compensation Philosophy | | | | ✓ Independent Board Chairman | | ✓ Annual Election of Trustees | | ✓ Stock Ownership Guidelines for Trustees and Executive Officers | | | | ✓ Independent Audit, Nominating and Compensation Committees | | ✓ Shareholder Approval Required to Classify Board | | ✓ Prohibition on Hedging Trust Stock | | | | ✓ Engaged and Diverse Board with 2 Female Trustees | | ✓ Majority Voting in Uncontested Elections | | ✓ Prohibition on Pledging Trust Stock | | | | ✓ Annual Board and Committee Evaluations, including individual Trustee evaluations | | ✓ Shareholder Right to Act by taking the number of Shares statedWritten Consent | | ✓ Clawback Policy in the Schedule 13G or 13G/A, as applicable, filed with the SEC divided by 72,172,665, the total number of Shares outstanding on March 14, 2017.Place |

(2) | Information based on a Schedule 13G/A filed with the SEC on February 10, 2017 by The Vanguard Group which states The Vanguard Group, an investment advisor, has sole voting power over 201,861 Shares, shared voting power over 99,825 Shares, sole dispositive power over 12,010,147 Shares and shared dispositive power over 211,986 Shares. | |

(3) | Information based on a Schedule 13G/A filed with the SEC on January 12, 2017 by BlackRock, Inc., which states BlackRock, Inc., a parent holding company, has sole voting power over 6,825,417 Shares and sole dispositive power over 7,538,685 Shares. |

(4) | Information based on a Schedule 13G filed with the SEC on February 6, 2017 by State Street Corporation, which states State Street Corporation, a parent holding company, has shared voting and dispositive power over 5,646,994 Shares. |

✓ No Poison Pill in Effect (5) | Information based on a Schedule 13G/A filed with the SEC on February 13, 2017 by Vanguard Specialized Funds—Vanguard REIT Index Fund which states that Vanguard Specialized Funds—Vanguard REIT Index Fund, an investment company registered under Section 8 of the Investment Company Act of 1940, has sole voting power over 5,419,307 Shares. |

(6) | Information based on a Schedule 13G filed with the SEC on February 14, 2017 by Invesco Ltd. which states that Invesco Ltd. has sole voting power over 2,064,045 Shares and sole dispositive power over 3,705,292. |

OWNERSHIP OF TRUSTEES AND EXECUTIVE OFFICERSBOARD LEADERSHIP STRUCTURE

As of March 14, 2017, our Trustees and executive officers beneficially owned the Shares reflected in the table below. This table reflects beneficial ownership determined in accordance with Rule13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and includes unvested Shares and options that may be exercised within 60 days of the date of this proxy statement. Except as noted in the footnotes that follow the table, each Trustee and executive officer has sole voting and investment power as to all Shares listed. Fractional Shares have been rounded to the nearest full Share.

| | | | | | | | | | | | | | | | | | | | | | Name and Address of Beneficial Owner (1) | | Common | | | Unvested

Restricted

Shares | | | Options

Currently

Exercisable or

Exercisable

Within 60

Days | | | Total

Shares

Beneficially

Owned | | | Percentage

of

Outstanding

Shares

Owned (2) | | Dawn M. Becker | | | 109,634 | | | | 11,829 | | | | 26,627 | | | | 148,090 | | | | * | | Jon E. Bortz (3) | | | 8,801 | | | | 0 | | | | 0 | | | | 8,801 | | | | * | | David W. Faeder | | | 8,458 | | | | 0 | | | | 0 | | | | 8,458 | | | | * | | Kristin Gamble (4) | | | 26,499 | | | | 0 | | | | 0 | | | | 26,499 | | | | * | | Daniel Guglielmone | | | 0 | | | | 15,842 | | | | 0 | | | | 15,842 | | | | * | | Elizabeth I. Holland | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | * | | Gail P. Steinel | | | 8,254 | | | | 0 | | | | 0 | | | | 8,254 | | | | * | | James M. Taylor, Jr. | | | 12,882 | | | | 0 | | | | 0 | | | | 12,882 | | | | * | | Warren M. Thompson | | | 8,333 | | | | 0 | | | | 0 | | | | 8,333 | | | | * | | Joseph S. Vassalluzzo | | | 20,001 | | | | 0 | | | | 0 | | | | 20,001 | | | | * | | Donald C. Wood (5) | | | 243,559 | | | | 90,362 | | | | 178,188 | | | | 512,109 | | | | * | | Trustees, trustee nominees and executive officers as a group (11 individuals) | | | 446,421 | | | | 118,033 | | | | 204,815 | | | | 769,269 | | | | 1.1 | % |

(1) | Unless otherwise indicated, the address of each beneficial owner is 1626 East Jefferson Street, Rockville, MD 20852. |

(2) | The percentage of outstanding Shares owned is calculated by taking the number of Shares reflected in the column titled “Total Shares Beneficially Owned” divided by 72,172,665, the total number of Shares outstanding on March 14, 2017, plus the number of options for such person or group reflected in the column titled “Options Currently Exercisable or Exercisable Within 60 Days.” |

(3) | As to these Shares, voting and investment power is shared with Mr. Bortz’ wife. |

(4) | Includes 15,448 Shares as to which Ms. Gamble shares investment power for clients. Includes 1,400 Shares as to which Ms. Gamble is a trustee of a profit sharing plan, of which Ms. Gamble has a direct interest in 581 Shares and of which 581 Shares are owned by Ms. Gamble’s husband’s estate. |

(5) | Includes 53,879 Shares owned by Mr. Wood’s wife. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Our Trustees, executive officers and any persons who beneficially own more than 10% of our Shares are required by Section 16(a) of the Exchange Act to file reports of initial ownership and changes of ownership of our Shares with the SEC and with the NYSE. To our best knowledge, based solely on review of copies of such

reports furnished to us and written representations that no other reports were required, the required filings of all such Trustees and executive officers were filed timely during 2016.

TRUSTEES AND CORPORATE GOVERNANCE INFORMATION

PROPOSAL 1—ELECTION OF TRUSTEES

Our Board of Trustees currently has eight Trustees. At the February 2017 Board meeting, Ms. Kristin Gamble advised the Board that she would not stand forre-election, having served on the Board for more than 20 years and nearing the Board’s retirement age. Ms. Gamble will continue to serve as Trustee through the May 2, 2017 Board meeting. At the time of the Annual Meeting, the Board will have seven Trustee positions and has nominated the remaining seven Board member to stand for election at the Annual Meeting to fill those positions. All trustees elected will hold office until the 2018 Annual Meeting of Shareholders and until their successors have been duly elected and qualified. During 2016, after discussion with one of our shareholders, the Board modified our Bylaws to provide that in uncontested elections such as this one, a nominee had to receive a majority of votes cast in order to be elected. Previously, a nominee had only to receive a plurality.

The Board recommends a vote FOR each of the nominees.

The following paragraphs provide biographies of each of our nominees that include information regarding the person’s service as a trustee, business experience, service on other boards and areas of skill and expertise that were considered by the Nominating and Corporate Governance Committee and the Board in deciding that such individual should serve on the Board.

Jon E. Bortz, age 60, has served on our Board since 2005. Mr. Bortz is currently the President, Chief Executive Officer and Chairman of the Board of Pebblebrook Hotel Trust, a REIT that acquires and invests in upper upscale hotels in large US cities (from 2009 to the present). Prior to that, Mr. Bortz was Chief Executive Officer and Chairman of the Board of LaSalle Hotel Properties for more than eight years. Mr. Bortz brings to the Board public company, REIT and real estate experience. His experience as chief executive officer of LaSalle Hotel Properties and Pebblebrook Hotel Trust provide a valuable perspective for running a public real estate company while his real estate experience at Jones Lang LaSalle provides fundamental real estate experience critical to our core business.

David W. Faeder, age 60, has served on our Board since 2003. Since 2003, Mr. Faeder has been a Managing Partner of Fountain Square Properties, a diversified real estate company. Over a10-year period prior to that. Mr. Fader held various positions at Sunrise Senior Living, Inc., a provider of senior living services in the United States, United Kingdom and Canada, including Vice Chairman, President and Executive Vice President and Chief Financial Officer. Mr. Faeder currently serves as a Director of Arlington Asset Investment Corp., a company that acquires and holds mortgage-related and other assets.Mr. Faeder is a valuable member of the Board because of his public company and accounting experience, having previously served as the president and chief financial officer of Sunrise Senior Living, and his real estate investment experience from his time as a private real estate investor.

Elizabeth Holland, age 51, has served on the Board since February 2017. Ms. Holland is the Chief Executive Officer of Abbell Credit Corporation and Abbell Associates, LLC, aseventy-year-old private real estate acquisition, development and management company with a portfolio of shopping center, office, and enclosed mall properties. She has held those roles since 1997. Prior to that, Ms. Holland was a practicing attorney and a fixed income portfolio manager. Ms. Holland is active in the International Council of Shopping Centers and serves as its Chairman of the Board of Trustees until May 2017. The Board views Ms. Holland’s retail real estate expertise and experience as Chairman of ICSC as valuable and complementary skill sets to have on the Board.

Gail P. Steinel, age 60, has served on the Board since 2006. Since 2007, Ms. Steinel has been the owner of Executive Advisors, a company that provides consulting services and leadership seminars. Ms. Steinel’s previous experiences were as Executive Vice President with BearingPoint, Inc., a management and technology consulting firm with responsibility for overseeing the global commercial services business unit and a global managing partner of Arthur Andersen’s business consulting practice. Ms. Steinel is currently a director of MTS Systems Corporation, a provider of mechanical test systems, material testing, fatigue testing and tensile testing equipment as well as motion simulation systems and calibration services. Ms. Steinel has over 25 years of auditing and consulting experience that provides the Board with a helpful perspective on managing risk and systems operations.

Warren M. Thompson, age 57, has served on the Board since 2007. Mr. Thompson is the President and Chairman of Thompson Hospitality Corporation, a food service company that owns and operates restaurants and contract food services, since founding the company in October 1992. Mr. Thompson’s experience running restaurants owneddirected by Thompson Hospitality provides the Board and management with a unique perspective that is shared by a large percentage of the Trust’s retail tenants.

Joseph S. Vassalluzzo, age 69, has served on the Board since 2002. Mr. Vassalluzzo has served as ourNon-Executive Chairman of the Board of Trustees since February 2006. From 1997 through 2005, Ms. Vassalluzzo held various positions, including Vice Chairman, with Staples, Inc., a retailer specializing in home, office, and computer products. Mr. Vassalluzzo currently serves as theNon-Executive Chairman of the Board of Office Depot, Inc. Mr. Vassalluzzo’s extensive background in retail and real estate as a result of having served as an executive with Staples, including his responsibility for expanding Staples real estate presence, as well as his service on the boards of a number of retailers provides the board and management with retail and retail real estate expertise that is essential to our core business.

Donald C. Wood, age 56, has served on the Board since 2003. Mr. Wood currently serves asThe Board believes that having its own leadership separate from our President and Chief Executive Officer positions he has held since 2003. Mr. Wood joined the Trust in 1998 and also held the positions of Chief Financial Officer and Chief Operating Officer. Currently, Mr. Wood is a director of Quality Care Properties, Inc., a real estate company focused on post-acute/skilled nursing and memory care/assisted living properties, and has previously served as a director of Post Properties, Inc., Chairman of the Board of the National Association of Real Estate Investment Trusts and a member of the Board of Governors of the International Council of Shopping Centers. Mr. Wood’s tenure with the Trust and his responsibilities as chief executive officer provides the Board with familiarityan effective way to ensure that they are fully informed and details onhave the opportunity to fully debate all aspectsimportant issues in order to fulfill its oversight responsibilities and hold management accountable for the performance of the operationsTrust. This also allows our Chief Executive Officer to focus his time on running ourday-to-day business. OurNon-Executive Chairman presides at all meetings of the Trust.Board and helps to set the agendas for Board meetings.

You are entitled to cast one vote per Share for each of the seven named individuals. Proxies may not be voted for more than seven individuals. The affirmative vote of a majority of votes cast at the Annual Meeting, in person or by proxy, is required for the election of each of the Trustees. If you are a “registered” shareholder and fail to give any instructions on your proxy card on this matter, the proxies identified on the proxy card will vote FOR each of the seven individuals in accordance with the Board’s recommendation. An “abstention” or broker“non-vote” will have no effect on the outcome of the vote on this proposal.

INDEPENDENCE OF TRUSTEES The Board reviews on an ongoing basis all relationships between us and each Trustee to determine whether each Trustee is independent or otherwise has any relationship to the Trust that could adversely affect the Trustee’s ability to exercise independent judgment and to confirm compliance with our Bylaws which provide that no more than one of our Trustees can fail to qualify as independent underjudgment. This review also determines whether each Trustee satisfies the independence requirements of the New York Stock Exchange (“NYSE”), the SEC, and our Corporate Governance Guidelines and other applicable rules and regulations.Guidelines. Our Corporate Governance Guidelines include a standard that a Trustee’s position as a director, officer or owner of a company with which we do business does not constitute a material relationship so long as payments made by that company do not account for more than five percent (5%) of our gross revenues or more than ten percent (10%) of the gross revenues of that company. The Board, on recommendation of the Nominating and Corporate Governance Committee, considered all relevant facts and circumstances and determined that all Trustees other than Mr. Ordan and Mr. Wood our Chief Executive Officer, are independent for purposes of Board and committee service under the standards of the NYSE, the SEC, our Corporate Governance Guidelines and applicable law for Board and Committee Service.law. In making thatthe independence determination, the Board took into account those relationships between us and our Trustees described in the “Certain Relationships and Related Transactions” section below and, with respect to Mr. Bortz, periodic use of Pebblebrook hotels for accommodations for conferences and business trips for various employees and, with respect to Mr. Vassalluzzo, five leases between Office Depot, Inc. and its wholly owned subsidiary, Office Max and the Trust. IDENTIFYING INDIVIDUALS TO STAND FOR ELECTION AS TRUSTEES

The Nominating and Corporate Governance Committee is responsible for identifying individuals to stand for election as Trustees. The Committee considers whether the current trustees have all of the requisite skills and perspectives necessary to effectively carry out the Board’s oversight function going forward. If the Committee determines that any changes are needed to the size or composition of the Board considered the Committee solicits recommendations on new members from other Board members and if no appropriate candidates are identified, the Committee will consider retaining a search firm. Recommendations provided by shareholders will also be considered and will be evaluated on the same basis as all other Board candidates.following:

In considering any individual to stand for election as a trustee, the Committee takes into account the overall mix of knowledge, experience, skills and expertise needed on the Board, the performance of incumbent trustees, and diversity characteristics such as geography, gender and ethnicity. All candidates for election to the Board should, at a minimum, possess public company, real estate, retail and/or other financial experience and have a history of honesty, integrity and fair dealing with third parties.

| | | Mr. Bortz | | Occasional usage by Trust employees for business purposes of hotels owned by Pebblebrook Hotel Trust. Mr. Bortz is the CEO of Pebblebrook Hotel Trust. | Mr. Faeder | | A1-year lease of space at a Trust property that expired in January, 2017 by an entity in which Mr. Faeder is a partner. | Mr. Thompson | | The items described in “Certain Relationships and Related Transactions” section below. | Mr. Vassalluzzo | | 5 leases between Office Depot, Inc. and the Trust. Mr. Vassalluzzo is theNon-Executive Chairman of the Board of Office Depot, Inc. |

Once a candidate is identified who has not previously served on the Board, the candidate meets with other Board members as well as our senior management and the Committee undertakes whatever investigative and due diligence activities it deems necessary to verify the candidate’s credentials, to determine whether the candidate would be a positive contributor to the operations of the Board and a good representative of our shareholders and to confirm that the candidate satisfies all of the independence requirements imposed by the NYSE, the SEC, our Corporate Governance Guidelines and other applicable rules and regulations.

Shareholders may propose a candidate to be nominated for election to the Board by following the procedures outlined in Article II, Section 13 of our Bylaws. Shareholders wanting to present a candidate for consideration as a Trustee for election at the Trust’s 2018 Annual Meeting of Shareholders must provide the Committee with the name of the shareholder proposing the candidate as well as contact information for that shareholder, the name of the individual proposed for election, a resume or similar summary that includes the individual’s qualifications and such other factual information that would be necessary or helpful for the Committee to evaluate the individual. The information should be sent to the Committee, in care of the Trust’s Secretary, by no later than November 23, 2017. A copy of our Bylaws may be obtained by sending a written request to Investor Relations at 1626 East Jefferson Street, Rockville, MD 20852.

BOARD OF TRUSTEES AND BOARD COMMITTEESMEETINGS Board of Trustees:

The Board of Trustees discharges its responsibilities throughholds regularly scheduledin-person meetings as well asand if needed, will also act through telephonic meetings, action by written consent and other communications with management. During 2016,2018, the Board of Trustees held five meetings, four meetings and theof which werein-person meetings. Thenon-management, independent Trustees held fouran executive sessions.session at each of those fourin-person meetings. Mr. Vassalluzzo, theNon-Executive Chairman of the Board, presided over all Board meetings as well as all executive sessions of thenon-management, Trustees during 2016.independent Trustees. TheNon-Executive Chairman of the Board is expected to preside over all future Board meetings and executive sessions ofnon-management, independent Trustees. Our Board is directed by aNon-Executive Chairman of the Board. The Board believes that having its own leadership separate from our Chief Executive Officer is the best structure for the Trust because it provides the

Board with an appropriate mechanism to fulfill its oversight responsibilities and hold management accountable for the performance of the Trust and also allows our Chief Executive Officer to focus his time on running ourday-to-day business.

Each of the Trustees attended 100% of allthe meetings of the Board and the Boardas well as 100% of all committee meetings, including committees on which eachthe Trustee serveddid not serve during 2016. Our Corporate Governance Guidelines provide that2018. It is the Trust’s policy for all Trustees are expected to attend all meetingsour annual meeting of the Board and the Board committees on which he or she serves as well as the Annual Meeting of Shareholders.shareholders absent exceptional cause. All Trustees attended our 20162018 Annual Meeting of Shareholders. Board Committees:

BOARD COMMITTEES The Board has three standing committees which are– the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee operates under a written charter which is available in the Investors section of our website atwww.federalrealty.com. Each committee member of these committees meets the independence, experience and, with respect to the Audit Committee, the financial literacy requirements, of the NYSE, the SEC and our Corporate Governance Guidelines. The membership, primary functions and number of meetings during 2016 forInformation about each of these standing committees are describedis included in the chart below: | | | | | Committee Members(1) | | Primary Responsibilities | | Number of Meetings

During 2016 | | | | Committee/Membership | | Primary Responsibilities | | # of 2018

Meetings | | | | Audit Committee:Committee: | | | | | | | | | | | | | Gail P. Steinel*Steinel(1) Jon E. Bortz David W. Faeder**Faeder(2) Warren M. Thompson | | • | | Selecting theour independent registered public accounting firmauditor and approving and overseeing its work;work | | 4 | | | | | | • | | Overseeing our financial reporting, including reviewing results with management and theour independent registered public accounting firm; andauditor | | • | | Overseeing our internal systems of accounting and controls | | • Overseeing risk management, including cybersecurity risk | | 4Overseeing financial, cybersecurity and similar risks | Compensation Committee: | | | | | Compensation Committee:

| | | | | | | | David W. Faeder*Faeder(1) Kristin GambleElizabeth I. Holland

Gail P. Steinel Joseph Vassalluzzo | | • | | Reviewing and recommending compensation for our senior officers;officers | | 2 | | | | | | • | | Administering our Amended and Restated 2001 Long-Term Incentive Plan (“2001 Plan”) and our 2010 Performance Incentive Plan (“2010 Plan”), including making awards under the 2010 Plan; andour long-term incentive award plans | | • | | Administering other benefit programs of the Trust | | 3 | | | Nominating and Corporate Governance Committee:Committee: | | | | | | | | | | Warren M. Thompson*Thompson(1) Jon E. Bortz Kristin GambleElizabeth I. Holland

Joseph S. Vassalluzzo | | • | | Recommending individuals to stand for election to the Board;Board | | 2 | | | | | | • | | Making recommendations regarding committee memberships; andmemberships | | • | | Overseeing our corporate governance policies and procedures, including Board and Trustee evaluations | | 4 |

*(1) | Denotes currentCommittee chairperson of the committee |

**(2) | Denotes our audit committee financial expert. |

Financial expert (1) | When Ms. Gamble’s service as a Trustee ends on May 2, 2017, Ms. Holland will replace Ms. Gamble as a member of the Compensation Committee and the Nominating and Corporate Governance Committee. |

RISK MANAGEMENT OVERSIGHT Although the

The Board has delegated to the Audit Committee responsibilityis responsible for overseeing our risksenterprise level risk of the Trust and exposures on an ongoing basis,does so directly and through its committees. As part of carrying out its risk oversight responsibilities, the entire Board regularly receives updates from management on the continued viability of our business plan, market conditions, capital position, and our business results and specifically reviews potential business risks from time to time. The Board reviews that information together with our quarterly and annual financial statements and operating results and short and long-term business prospects to assess the risks that we may encounter and to establish appropriate direction to avoid or minimize the potential impact of the identified risks. Some of the details that are discussed as part of the Board’s review of potential risks facing us include, without limitation: (a) the impact of market conditions on our business; (b) operational risks such as the ability of our tenants to be successful and the ability to grow the company through increasing rents and redeveloping our properties; (c) liquidity and credit risks, including our ability to access capital to run and grow our business and our overall cost of capital and the impact on our profitability; (d) investment risks from acquisitions and our development and redevelopment projects; (e) regulatory risks that may impact our profitability such as environmental laws and regulations, the Americans with Disabilities Act of 1990 and various other federal, state and local laws; (f) REIT profitability; risks such asrelating to our failure to qualifystatus as a REIT for federal income tax purposes; (g) real estate investment trust; environmental related risks; cybersecurity risks; and (h) general risks inherent in the real estate industry. TRUSTEE COMPENSATION RISK ASSESSMENT

Non-employee Trustees received the following fees

In February 2019, our Compensation Committee reviewed our compensation policies and practices for their serviceall of our employees to determine whether any of such policies or programs created any risk that is reasonably likely to have a material adverse effect on the Board in 2016: | | | | | Annual Retainer forNon-Employee Trustees | | $ | 175,000 | | Annual Retainer forNon-Executive Chairman | | $ | 250,000 | | Annual Fee for Audit Committee Chairman | | $ | 20,000 | | Annual Fee for Compensation Committee Chairman | | $ | 10,000 | | Annual Fee for Nominating Committee Chairman | | $ | 10,000 | |

The annual retainers forTrust. Based on that review, the Committee does not believe that our Trustees are paid sixty percent (60%) in Shares and forty percent (40%) in cash andcompensation programs encourage unnecessary or excessive risk taking. Specifically, the incentive compensation of 95% of our employees is based solely on corporate performance objectives. For the approximately 5% of our employees who earn all chair fees are paid in cash. The equityor a portion of the annual retainer for 2016 was paid in Shares on January 3, 2017 with the number of Shares receivedtheir compensation by each Trustee determined by dividing the amount of the annual retainer to be paid in Shares by $142.11, thecompleting leasing transactions or closing price of our Shares on the NYSE on December 30, 2016, the last business day prior to the date the Shares were issued. Each Trustee is required to hold at all times an amount of Shares valued at least at five times the amount of the cash portion of the annual retainer. As of December 31, 2016, all Trustees then serving onacquisitions, they cannot complete any deals without first obtaining approvals from either the Board complied with the required leveland/or one or more members of stock ownership.senior management whose incentive compensation is tied to corporate performance.

In addition to the annual retainer described above, Mr. Vassalluzzo receives administrative support for both Trust business and personal use from our regional office in Wynnewood, Pennsylvania. There were no additional fees paid or services provided to any Trustee for service on any of the Board committees or for attendance at any Board or committee meetings other than those described above.

Total compensation awarded to Trustees for service in 2016 was as follows:

| | | | | | | | | | | | | | Name | | Fees Earned or

Paid in Cash | | | All Other

Compensation | | | Total | | | (1) | | ($)(2)(3) | | | ($) (4) | | | ($) | | Jon E. Bortz | | $ | 175,000 | | | $ | — | | | $ | 175,000 | | David W. Faeder | | $ | 185,000 | | | $ | — | | | $ | 185,000 | | Kristin Gamble | | $ | 175,000 | | | $ | — | | | $ | 175,000 | | Gail P. Steinel | | $ | 195,000 | | | $ | — | | | $ | 195,000 | | Warren M. Thompson | | $ | 185,000 | | | $ | — | | | $ | 185,000 | | Joseph S. Vassalluzzo | | $ | 250,000 | | | $ | 7,378 | | | $ | 257,378 | | | | | | | Total | | $ | 1,165,000 | | | $ | 7,378 | | | $ | 1,172,378 | |

(1) | Elizabeth Holland became a Trustee on February 1, 2017. |

(2) | For each Trustee other than Mr. Vassalluzzo, $105,000 of this amount was paid in Shares and for Mr. Vassalluzzo, $150,000 of this amount was paid in Shares. |

(3) | As of December 31, 2016, Mr. Bortz owned 8,062 Shares; Mr. Faeder owned 7,719 Shares; Ms. Gamble owned 9,493 Shares; Ms. Steinel owned 7,515 Shares; Mr. Thompson owned 7,594 Shares; and Mr. Vassalluzzo owned 18,945 Shares. |

(4) | The amount in the “All Other Compensation” column represents our estimated value of the administrative services we made available to Mr. Vassalluzzo. We believe there is no incremental cost to us of providing this administrative support. |

For 2017, the annual retainer fornon-employee Trustees will be $190,000 and for ourNon-Executive Chairman of the Board will be $265,000. No other changes were made to any Trustee compensation for 2017.

COMMUNICATIONS WITH THE BOARD Any shareholder of the Trust or any other interested party may communicate with the Board as a whole, thenon-management Trustees of the Board as a group, theNon-Executive Chairman of the Board, and/or any individual Trustee by sending the communication to the Trust’s corporate offices at 1626 East Jefferson Street, Rockville, MD 20852 in care of the Trust’s Secretary. All such communicationcommunications should identify the party to whom it is being sent, and any communication which indicates it is for the Board of Trustees or fails to identify a particular Trustee will be deemed to be a communication intended for the Trust’sNon-Executive Chairman of the Board. The Trust’s Secretary will promptly forward to the appropriate Trustee all communications she receives for the Board or any individual Trustee which relate to the Trust’s business, operations, financial condition, management, employees or similar matters. The Trust’s Secretary will not forward to any Trustee any advertising, solicitation or similar materials. OTHER CORPORATE DOCUMENTSCERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Board

Review and Approval of Trustees has adopted a Code of Ethics for senior financial officers as well as aRelated Party Transactions Our Code of Business Conduct requires that applies toour Trustees and all of our Trusteesemployees deal with the Trust on an arms-length basis in any related party transaction. All transactions between us and employees. In addition, the Board operates under Corporate Governance Guidelines. The Code of Ethics for our senior financial officers, our Code of Business Conduct and our Corporate Governance Guidelines are available in the Investors sectionany of our website atwww.federalrealty.com. AUDIT INFORMATION

REPORT OF THE AUDIT COMMITTEE

The following ReportTrustees, our named executive officers or other vice presidents, or entity in which any of them has an ownership interest must be approved in advance by the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Trust filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Trust specifically incorporates this Report by reference therein.

Our role as the Audit Committee is to oversee the financial reporting process on behalf of the Board, including oversight of the Trust’s management, internal auditor and independent registered public accounting firm in their performance of the following functions:

Management is responsible for the financial reporting process, including the system of internal controls, for the preparation of consolidated financial statements in accordance with generally accepted accounting principles in the United States (“GAAP”) and for management’s report on internal control over financial reporting

Grant Thornton, LLP (“GT”), the Trust’s independent registered public accounting firm, is responsible for auditing the consolidated financial statements and expressing an opinion on the financial statements and the effectiveness of internal control over financial reporting

PricewaterhouseCoopers LLP (“PwC”) , the Trust’s internal audit firm, is responsible for the Trust’s internal audit function including oversight of the ongoing testing of the effectiveness of our internal controls

The Audit Committee meets at least quarterly and at such other times as it deems necessary. The Audit Committee held four meetings in 2016 and met three times with GT in executive session without management being present and met with PwC three times including once without management being present.

During 2016, the Audit Committee:

Reviewed with management and GT, individually and collectively, all annual and quarterly financial statements and operating results prior to their issuance. Management has advised the Audit Committee that all financial statements were prepared in accordance with GAAP;

Discussed with GT matters required to be discussed pursuant to applicable audit standards, including the reasonableness of judgments and the clarity and completeness of financial disclosures;

Reviewed and discussed with GT and PwC, individually and collectively, the ongoing assessment and testing of the Trust’s systems of internal controls and procedures. As part of its 2016 audit of our financial statements, GT independently reviewed our system of internal controls and procedures and issued an unqualified report thereon;

Discussed with GT matters relating to GT’s independence from the Trust and received written confirmation from GT that GT is not aware of any relationships, that in their professional judgment may impair their independence; and;

Monitored thenon-audit services provided by GT to ensure that performance of such services will not adversely impact GT’s independence. That included approval of thenon-audit services for 2017 described in the “Ratification of Independent Registered Public Accounting Firm” section below and an audit for one of our consolidated properties with partners.

Based on the Audit Committee’s reviews and discussions with GT, PwC and management, the Audit Committee recommended to the Board of Trustees that the Board approve the inclusion of our audited financial statements in our Annual Report on Form10-K for the fiscal year ended December 31, 2016 for filing with the SEC.

Submitted by:

Gail P. Steinel, Chairperson

Jon E. Bortz

David W. Faeder

Warren M. Thompson

INFORMATION ABOUT OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The following table sets forth the amount of fees billed or expected to be billed by GT for the years ended December 31, 2016 and 2015:

| | | | | | | | | | | | 2016 | | | 2015 | | Audit Fees(1) | | $ | 652,808 | | | $ | 654,051 | | Audit-Related Fees(2) | | | 61,950 | | | | 59,063 | | Tax Fees(3) | | | 255,791 | | | | 287,854 | | Other | | | 0 | | | | 0 | | | | | | | | | | | Total | | $ | 970,549 | | | $ | 1,000,968 | |

(1) | Audit fees include all fees and expenses for services in connection with: (a) the audit of our financial statements included in our annual reports on Form10-K; (b) Sarbanes-Oxley Section 404 relating to our annual audit; (c) the review of the financial statements included in our quarterly reports on Form10-Q; and (d) consents and comfort letters issued in connection with debt offerings and common Share offerings. These figures do not include $15,750 in 2015 we paid to GT as our 30% share of the cost of the 2015 financial statement audits of our joint venture with affiliates of a discretionary fund created and advised by Clarion Partners. On January 13, 2016 we acquired the Clarion Partners interest in the joint venture arrangement. |

(2) | Audit-related fees include the audit of our employee benefit plan and certain property level audits. |

(3) | $246,070 and $234,224 of the amounts shown for 2016 and 2015, respectively, relate solely to tax compliance and preparation, including the preparation of original and amended tax returns and refund claims and tax payment planning. These figures do not include $6,645 in 2016 and $3,210 in 2015 we paid to GT as our 30% share of the cost of tax return preparation for our joint venture with affiliates of a discretionary fund created and advised by Clarion Partners. On January 13, 2016 we acquired the Clarion Partners interest in the joint venture arrangement. The remaining amounts relate to requested tax research, none of which research related to tax shelters. |

The Audit Committeepre-approved all services provided by GT in 2016.

PROPOSAL 2—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee is asking shareholders to ratify its selection of GT as our independent registered public accounting firm for the fiscal year ending December 31, 2017. Our organizational documents do not require ratification of the selection of our independent registered public accounting firm; however, we believe that it is a matter of good corporate practice to do so. If the selection of GT is not ratified, the Audit Committee may reconsider whether to retain GT. Even if the selection of GT is ratified, the Audit Committee may change the appointment of GT at any time if it determines such a change would be in the best interests of the Trust and our shareholders.

The Board recommends a vote FOR this proposal.

A representative of GT will be present at the Annual Meeting and will have the opportunity to make a statement if they so desire and answer appropriate questions from shareholders.

The Audit Committee believes that GT is qualified to serve as our independent registered public accounting firm. GT is familiar with our affairs and financial procedures having served as our independent accountant since June 2002 and is registered with the Public Company Accounting Oversight Board.

As required by its charter, the Audit Committee has approved the followingnon-audit services for 2017, the scope and amount of which has remained unchanged for the last few years:

tax planning and other consultation for purposes of structuring acquisitions, dispositions, joint ventures and other investment or financing opportunities as well as consultation associated with financial reporting matters up to a maximum of $100,000;

issuance of comfort letters and consents in connection with capital markets transactions up to a maximum of $150,000;

issuance of audit opinions related to acquisition audits required under Rule3-14 of RegulationS-X up to up to a maximum of $125,000; and

agreed upon procedures covering the Trust’s letter to the State of California Department of Environmental Quality up to up to a maximum of $3,750.

Committee. Audit Committee approval is not required for us to enter into a lease with an entity in which any of our Trustees is a director, employee or owner so long as the lease is entered into in the ordinary course of business and is negotiated at arms-length and on market terms. Related Party Transactions Mr. Thompson, one of our Trustees, serves as the President and Chairman of the Board of Directors of Thompson Hospitality Corporation (“THC”). THC leases from us two restaurant locations. Those leases were negotiated at arms’ length, reflecting market conditions at the time they were negotiated, and are scheduled to expire on June 30, 2020 and December 31, 2027. In addition, in 2018 THC acquired an ownership interest in two additional restaurant tenants. Both of these restaurant leases were negotiated at arms’ length prior to their acquisition by THC and are scheduled to expire on November 30, 2020 and October 31, 2027, subject to a tenant extension option. In the aggregate, we received approximately $1.1 million in rent and other related charges in 2018, anticipate receiving approximately $1.5 million in rent and other charges in each of 2019 and 2020 and then less than $1.0 million annually in rent and other charges through the remaining terms of these leases. The Board reviewed these relationships with Mr. Thompson and determined that Mr. Thompson met in 2018 and currently meets all independence requirements for his service as a Trustee as described in the “Independence of Trustees” section above. None of our named executive officers had or has any indebtedness to the Trust or any relationship with the Trust other than as an employee and shareholder. Employment andnon-auditchange-in-control services orarrangements between the Trust and the named executive officers are described in the “Potential Payments on Termination of Employment andChange-in-Control” section below. PROPOSAL 1 – ELECTION OF TRUSTEES Our Board of Trustees currently has eight Trustees, all of whom have been nominated to stand fornon-audit services election at the 2019 Annual Meeting. All trustees elected at the meeting will hold office until the 2020 Annual Meeting of Shareholders and until their successors have been duly elected and qualified. You are entitled to cast one vote per Share for each of the eight named individuals. Proxies may not be voted for more than eight individuals. Our Bylaws provide that exceed the above limits. The affirmative vote ofin uncontested elections such as this one, a nominee must receive a majority of votes cast at the Annual Meeting, in person or by proxy, is requiredorder to approve this proposal. If you fail to give any instructions on your proxy card on this matter, the proxies identified on the proxy card will vote FOR this proposal.be elected. An “abstention” or broker“broker“non-vote” will have no effect on the outcome of the vote on this proposal, however, if you fail to give instructions to your broker, your broker may have authority to vote the shares for this proposal.

| | | | |  | | The Board recommends that you vote “FOR” each of the nominees. |

EXECUTIVE OFFICERNOMINEES

The Nominating and Corporate Governance Committee is responsible for identifying individuals who are qualified candidates to serve on our Board. The committee has identified the following eight individuals to stand for election at our 2019 Annual Meeting of Shareholders. Each of these nominees is currently a member of our Board. | | | | | | Jon E. Bortz |

| | Age: 62 Trustee since: 2005 Independent | | Business Experience: • President, Chief Executive Officer and Chairman of the Board of Pebblebrook Hotel Trust (2009 – present) • Various positions with LaSalle Hotel Properties including President, Chief Executive Officer, Trustee and Chairman of the Board (1998 – 2009) | Committees: | | | | Public Company Boards | • Audit | | | | • Pebblebrook Hotel Trust (2009 – present) | • Nominating and Corporate Governance | | | Specific Qualifications and Skills: Mr. Bortz brings to the Board public company, REIT and real estate experience. His experience as chief executive officer of LaSalle Hotel Properties and Pebblebrook Hotel Trust provide a valuable perspective for running a public real estate company while his real estate experience at Jones Lang LaSalle provides fundamental real estate experience critical to our core business. |

| | | | | | David W. Faeder |

| | Age: 62 Trustee since: 2003 Independent | | Business Experience: • Managing Partner of Fountain Square Properties (2003 – present) • Various positions with Sunrise Senior Living, Inc. including Vice Chairman-President and Executive Vice President-Chief Financial Officer (1993 – 2003) | Board Committees: | | Public Company Boards: | • Audit | | • Arlington Asset Investment Corp. (2013 – present) | • Compensation (Chair) | | | Specific Qualifications and Skills: Mr. Faeder provides public company experience, accounting experience and real estate investing acumen to the Board, having previously served as the president and chief financial officer of Sunrise Senior Living and as an active private real estate investor. |

| | | | | | | Elizabeth I. Holland |

| | Age: 53 Trustee since: 2017 Independent | | Business Experience: • Chief Executive Officer of Abbell Credit Corporation and Abbell Associates, LLC (1997 – present) • Board of Trustees of the International Council of Shopping Centers (from 2004 – 2010 and 2015 – present), Chairman of the Board of Trustees (2016 – 2017) and Vice Chairman of the Board of Trustees (2015 – 2016) | Board Committees: | | Public Company Boards: | • Compensation | | • VICI Properties, Inc. (2017 – present) | • Nominating and Corporate Governance | | | Specific Qualifications and Skills: Ms. Holland brings to the Board a deep understanding of owning and investing in retail real estate from her experience as a private investor. Her insights into issues affecting many of our tenants learned from her experience as Chairman of the International Council of Shopping Centers also provides a valuable perspective for the Board to understand the Trust’s business. |

| | | | | | Mark S. Ordan |

| | Age: 60 Trustee since: 2019 Non-Management | | Business Experience: • Chief Executive Officer and Chairman of the Board of Quality Care Properties (2016 – 2018) • Executive Chairman of the Board (2015 – 2016) and Chief Executive Officer (2014 – 2015) of Washington Prime Group • Chief Executive Officer of Sunrise Senior Living, Inc.

(2008 – 2013) and Chief Executive Officer of Sunrise Senior Living, LLC (2013), its successor • Chief Executive Officer and President of The Mills Corporation (2006 – 2007) | Board Committees: | | Public Company Boards: | • None | | • VEREIT, Inc. (2015 – present) | | | • Forest City Realty Trust, Inc. (2018) • Quality Care Properties, Inc. (2016 – 2018) • Washington Prime Group (2014 – 2017) | Specific Qualifications and Skills: Mr. Ordan’s extensive public company leadership experience in the REIT industry and past retailing experience provides the Board and management with retail, real estate and public company perspectives that are critical to the day to day operation of our business. |

| | | | | | Gail P. Steinel |

| | Age: 62 Trustee since: 2006 Independent | | Business Experience: • Owner of Executive Advisors (2007 – present) • Executive Vice President of BearingPoint, Inc. (2002 – 2007) • Global Managing Partner of Management and Technology Consulting Practice for Arthur Andersen (1984 – 2002) | Board Committees: | | Public Company Boards: | • Audit (Chair) | | • MTS Systems Corporation (2009 – present) | • Compensation | | | Specific Qualifications and Skills: Ms. Steinel has over 25 years of auditing and consulting experience that provides the Board with valuable accounting and financial expertise, as well as a helpful perspective on leadership and on managing risk and systems operations. |

| | | | | | Warren M. Thompson |

| | Age: 59 Trustee since: 2007 Independent | | Business Experience: • President and Chairman of Thompson Hospitality Corporation since founding the company (1992 – present) | Board Committees: | | Public Company Boards: | • Audit | | • Duke Realty Corporation (2019 – present) | • Nominating and Corporate Governance (Chair) | | | Specific Qualifications and Skills: Mr. Thompson’s experience running restaurants owned by Thompson Hospitality provides the Board and management with a unique perspective that is shared by a large percentage of the Trust’s retail tenants. |

| | | | | | Joseph S. Vassalluzzo |

| | Age: 71 Trustee since: 2002 Non-Executive Chairman Independent | | Business Experience: • Non-Executive Chairman of the Board of Office Depot, Inc. (2017 – present) • Non-Executive Chairman of the Board of Federal Realty Investment Trust (2006 – present) • Various positions including Vice Chairman with Staples, Inc. (1989 – 2005) | Board Committees: | | Public Company Boards: | • Compensation | | • Office Depot, Inc. (2013 – present) | • Nominating and Corporate Governance | | • Life Time Fitness, Inc. (2006 – 2015) | Specific Qualifications and Skills: Mr. Vassalluzzo’s extensive background in retail and real estate as a result of having served as an executive with Staples, including his responsibility for expanding Staples real estate presence, as well as his current and prior service on the boards of a number of retailers provides the board and management with retail and retail real estate expertise that is essential to our core business. |

| | | | | | Donald C. Wood |

| | Age: 58 Trustee since: 2003 CEO | | Business Experience: • President and Chief Executive Officer of Federal Realty Investment Trust (2003 – present) and various other positions including Chief Financial Officer and Chief Operating Officer (1998 – 2003) • Chairman of the Board of the National Association of Real Estate Investment Trusts (2011 – 2012) • Board of Governors of the International Council of Shopping Centers (2010 – present) | Board Committees | | Public Company Boards: | • None | | • Quality Care Properties, Inc. (2016 – 2018) • Post Properties, Inc. (2011 – 2016) | Specific Qualifications and Skills: Mr. Wood’s tenure with the Trust and his responsibilities as chief executive officer provides the Board with familiarity and details on all aspects of the operation of the Trust. |

QUALIFICATIONS AND COMPENSATION INFORMATIONCHARACTERISTICS OF TRUSTEES EXECUTIVE OFFICERS

Our current “named executive officers” are:In determining who should stand for election as a Trustee, the Nominating and Corporate Governance Committee tries to ensure that the Board is composed of individuals whose backgrounds, skills and experiences, when taken together, will provide the Board with the range of skills and expertise to be able to effectively guide and oversee our strategy, operations and management. At a minimum, candidates should have the ability to exercise judgment in fulfilling his/her responsibilities, a professional background that would enable him/her to understand our business, public company, real estate, retail and/or other financial experience and a history of honesty, integrity and fair dealing with third parties. The skills and experience of the Trustees in areas we consider critical to our business are described in detail in the biographies above and summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Age | | | | | | | | | Qualifications/Skills of Nominees | | Bortz | | Faeder | | Holland | | Ordan | | Steinel | | Thompson | | Vassalluzzo | | Wood | | | | | | | | | | Business/Executive Leadership | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | | REIT/Public Company | | ● | | ● | | ● | | ● | | ● | | | | ● | | ● | | | | | | | | | | Investment/Financial/Accounting | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | Real Estate | | ● | | ● | | ● | | ● | | | | | | ● | | ● | | | | | | | | | | Retailing Industry | | | | | | ● | | ● | | | | ● | | ● | | | | | | | | | | | | Operational Management | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | Risk Oversight/Management | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● |

The Nominating and Corporate Governance Committee also seeks geographic, age, tenure, gender and ethnic diversity on the Board. Although the Board has not adopted any specific policies on diversity, the Nominating and Corporate Governance Committee and the Board believe that diversity is a factor to be considered, consistent with the goal of creating a Board that best serves the needs of the Trust and our shareholders. Our nominees reflect the Board’s efforts and commitment to diversity with two women and one African American included in that group. The Board also made the determination over the past year that the effectiveness of the Board’s oversight function would be further enhanced by adding a trustee who had recent and broad REIT and public company expertise given the dynamics of a changing marketplace. As a result, the Board increased its size from seven to eight trustees and elected Mark Ordan to fill the newly created position. Mr. Ordan’s selection is described in more detail below. PROCESS FOR SELECTING TRUSTEES In considering nominees to stand for election at the Annual Meeting, the Board and the Committee evaluate each person’s background, qualifications and attributes to serve as a Trustee based on the criteria described above and for incumbent Trustees, their years of experience working together on the Board and the deep knowledge of the Trust they have developed as a result of such service on the Board. This is especially important in our company where real estate decisions and strategy often take years to develop and require a full understanding of history in setting strategies and making decisions. The Board and the committee also consider each incumbent Trustee’s contributions to the effectiveness of the Board and its committees based on thein-depth individual trustee assessments completed each year for each Board member by each other Board member. To identify, recruit and evaluate qualified candidates for the Board, the Board first looks to individuals known to current Board members through business and other relationships. If the Board is not able to identify qualified candidates in that way, the services of a professional search firm would be used. Mr. Ordan was identified by Board members from his extensive, recent experience leading public companies, including real estate companies, as well as his retailing experience and familiarity with the Trust and current Board members. Until July 2018, Mr. Ordan served as Chief Executive Officer of QCP Properties, Inc., a real estate investment trust focused on post-acute/skilled nursing and memory care/assisted living properties. Our chief executive officer, Mr. Wood served on the board of QCP Properties and on its compensation committee at the same time. As a result of Mr. Wood’s service on the QCP Properties compensation committee, Mr. Ordan will not satisfy the requirements to be considered an independent trustee under the NYSE listing standards until August 2021. The Committee and the Board considered this fact and determined that the perspectives Mr. Ordan would bring to the table as a trustee would be very valuable today and outweighed any concerns with his not satisfying the independence requirements of the NYSE until August 2021. PROCESS FOR SHAREHOLDERS TO RECOMMEND TRUSTEE NOMINEES Shareholders may propose a candidate to be nominated for election to the Board by following the procedures outlined in our Bylaws, a copy of which can be obtained by sending a written request to Investor Relations at 1626 East Jefferson Street, Rockville, Maryland 20852. If you want to recommend a nominee, you can submit a written recommendation in accordance with our Bylaws that includes the name, qualifications and other pertinent information about the nominee to the Trust’s Secretary at our Rockville office. Any recommendation for a nominee to be considered at our 2020 Annual Meeting must be submitted no later than November 23, 2019. TRUSTEE COMPENSATION Ournon-employee Trustees receive the following compensation for their service on the Board: | | | Compensation Element | | Amount | Non-Executive Chairman Annual Retainer—Paid in Cash | | $106,000 | Non-Executive Chairman Annual Retainer—Paid in Shares | | $159,000 (fully vested on grant date) | Non-Employee Trustee Annual Retainer—Paid in Cash | | $76,000 | Non-Employee Trustee Annual Retainer—Paid in Shares | | $114,000 (fully vested on grant date) | Committee Chair Fees—Paid in Cash | | $20,000 for Audit Committee $10,000 for Compensation Committee $10,000 for Nominating Committee | Equity Ownership Guidelines | | Trustees are required to maintain ownership of Trust stock having a value equal to 5 times the amount of the annual cash retainer. This requirement must be met within 5 years after joining the Board |

As of December 31, 2018, all Trustees then serving on the Board complied with the required level of stock ownership with the exception of Ms. Holland, who joined the Board in February 2017, and is expected to satisfy the requirement within the5-year time frame. Mr. Ordan’s compliance with this requirement will be assessed beginning December 31, 2019. In addition to the annual retainer described above, Mr. Vassalluzzo receives administrative support for both Trust business and personal use from our regional office in Wynnewood, Pennsylvania. There were no additional fees paid or services provided to any Trustee for service on any of the Board committees or for attendance at any Board or committee meetings other than those described above. The levels of Trustee compensation have remain unchanged since 2017. These levels were set after reviewing board compensation being paid to more than 28 public real estate investment trusts at that time and were determined to be reasonable market compensation based on that information. Total compensation awarded to Trustees for service in 2018 was as follows: | | | | | | | | | | | | | | | | | | | | | | Annual Retainer | | Committee Chair Fees | | All Other Compensation | | Total | | Name(1) | | Paid in Cash | | Paid in Shares(2) | | | | | | | Jon E. Bortz | | $ 76,000 | | $114,000 | | $ — | | $ — | | $ | 190,000 | | | | | | | | David W. Faeder | | $ 76,000 | | $114,000 | | $10,000 | | $ — | | $ | 200,000 | | | | | | | | Elizabeth I. Holland | | $ 76,000 | | $114,000 | | $ — | | $ — | | $ | 190,000 | | | | | | | | Gail P. Steinel | | $ 76,000 | | $114,000 | | $20,000 | | $ — | | $ | 210,000 | | | | | | | | Warren M. Thompson | | $ 76,000 | | $114,000 | | $10,000 | | $ — | | $ | 200,000 | | | | | | | | Joseph S. Vassalluzzo(3) | | $106,000 | | $159,000 | | $ — | | $8,000 | | $ | 273,000 | | | | | | | | Total | | $486,000 | | $729,000 | | $40,000 | | $8,000 | | $ | 1,263,000 | |

| (1) | Mark S. Ordan did not become a Trustee until February 1, 2019 and as a result, is not included in this chart. |

| (2) | Shares were issued on January 2, 2019 with the number of Shares received by each Trustee determined by dividing the amount to be paid in Shares by $118.04, the closing price of our Shares on the NYSE on December 31, 2018, the last business day prior to the date the Shares were issued. |

| (3) | The amount in the “All Other Compensation” column represents the estimated value of the administrative services. We do not believe there is any incremental cost to us of providing this administrative support. |

| | EXECUTIVE OFFICER AND COMPENSATION INFORMATION |

EXECUTIVE OFFICERS Our named executive officers (“NEOs”) are: | | | | | | | | Name | | Age | | Position | | | | Donald C. Wood | | | 5658 | | | President and Chief Executive Officer | | | | Daniel Guglielmone (1) | | | 5052 | | | Executive Vice President—President – Chief Financial Officer and Treasurer | | | | Dawn M. Becker | | | 5355 | | | Executive Vice President—President – General Counsel and Secretary |

(1) | Mr. Guglielmone became the Trust’s Executive Vice President—Chief Financial Officer and Treasurer on August 15, 2016. Mr. James M. Taylor, Jr. served as the Trust’s Executive Vice President—Chief Financial Officer and Treasurer from January 1, 2016 through May 19, 2016. |

Donald C. Wood, Information for Mr. Wood is provided above in “Proposal 1—1 – Election of Trustees.” Daniel Guglielmone, Executive Vice President—President – Chief Financial Officer and Treasurer of the Trust (since August 2016) with responsibility for overseeing the Trust’s capital markets, financial reporting, investor relations, corporate communications and East Coast acquisitions; Senior Vice President—AcquisitionsPresident-Acquisitions & Capital Markets of Vornado Realty Trust (2003—(2003 – 2016); Director of the real estate and lodging group in investment banking of Salomon Smith Barney / Citigroup (1993—(1993 – 2003) and the retail division of Douglas Elliman Commercial Real Estate (1989 to– 1992). Dawn M. Becker, Executive Vice President—President – General Counsel and Secretary (since April 2002) with responsibility for overseeing various of the Trust’s corporate functions including the Trust’s Legal, Human Resources and Information Technology Departments; and prior to that time, various officer positions with the Trust, including Executive Vice President—President – Managing Director Mixed Use Operations (2015 to– 2016), Executive Vice President—President – Chief Operating Officer (2010 to– 2015) and Vice President—President–Real Estate and Finance Counsel (2000 to– 2002). PROPOSAL 2 – ADVISORY VOTE ON THE COMPENSATION DISCUSSION AND ANALYSISOF OUR NAMED EXECUTIVE OFFICERS This

You are being asked to approve on an advisory basis the compensation of our NEOs as described in the Compensation Discussion and Analysis (“CD&A”) describes, the material components of,Summary Compensation Table, the supplemental tables and the material factors and considerations behind,disclosure narratives that follow. This is an opportunity to express your opinion regarding the compensation and benefits paid to our named executive officers for 2016 who are: Donald C. Wood, President and Chief Executive Officer;

Daniel Guglielmone, Executive Vice President—Chief Financial Officer and Treasurer (effective August 15, 2016);

Dawn M. Becker, Executive Vice President—General Counsel and Secretary; and

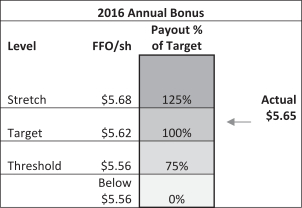

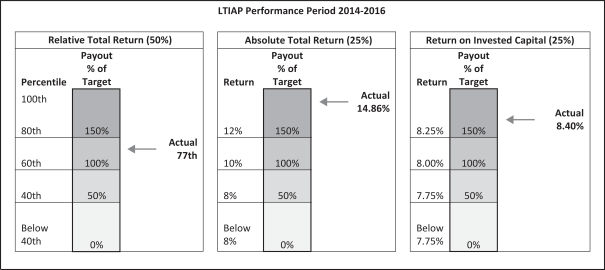

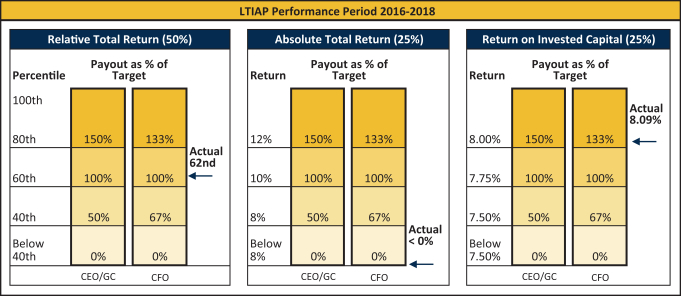

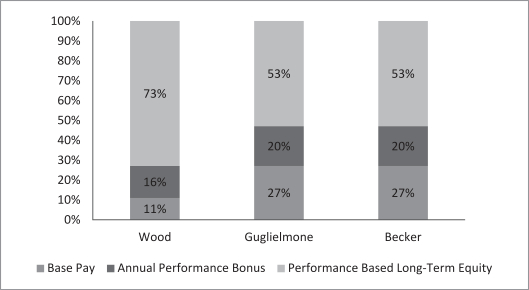

James M. Taylor, Jr., former Executive Vice President—Chief Financial Officer and Treasurer (January 1—May 19, 2016)